5 Credit Union Growth Challenges for 2025

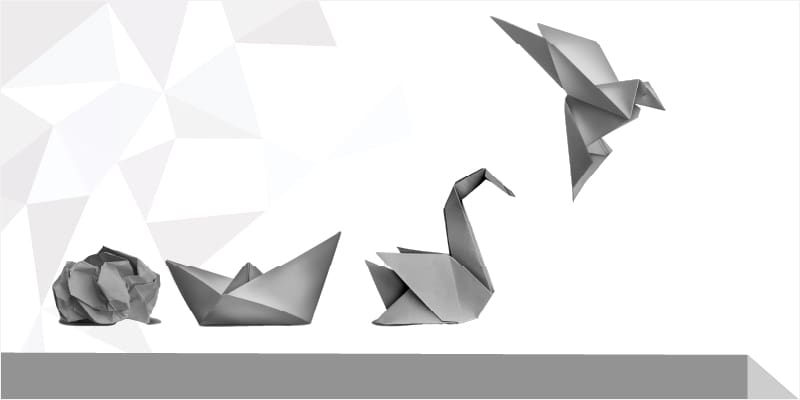

Credit unions were built on strong values like service, trust, and community. But today, many are stuck in survival mode. Busy with daily operations, compliance tasks, and member demands, they focus so much on the present that they unintentionally compromise the future.

Sustainable growth is often overlooked, not due to lack of vision, but because teams are overwhelmed. There’s no time to step back and align people, processes, technology, and systems with long-term goals. This gap puts credit unions at risk—not just of falling behind, but of losing relevance in a fast-changing world.

Let’s take a closer look at five major challenges blocking sustainable growth—and how strategic outside help can make a real difference.

1. Regulatory Shifts Demand Constant Attention

With a new administration comes new rules—especially around consumer protection. Compliance teams are working overtime to keep up. But when all your energy goes toward reacting, there’s no space left to plan, innovate, or grow. It’s a cycle that keeps you stuck in the now.

2. Cybersecurity and Fraud Are Growing Threats

AI is changing financial services—but it’s also arming fraudsters with more sophisticated tools. Credit unions, especially those with outdated systems, struggle to keep pace. Cybersecurity can’t be an afterthought. Without strong defenses, you risk member trust and operational stability.

3. A Talent Crunch Is Slowing Progress

Leadership is aging. Institutional knowledge is locked in silos. And finding new talent with the digital, data, and strategic skills needed for growth is harder than ever. The result? Strategic planning suffers, and innovation stalls before it can even start.

4. Member Growth Is Getting Tougher

FinTech’s and big banks are ahead in delivering personalized, digital-first experiences. They’re fast, flexible, and always on. Credit unions can’t compete with one-size-fits-all messaging or clunky systems. To grow, you need smarter marketing, sharper tools, and strategies that speak to today’s members.

5. Outdated Systems Are Slowing You Down

Manual processes, legacy systems, and tech debt create major inefficiencies—slower service, frustrated staff, and missed opportunities. Members expect speed, convenience, and digital tools. If you’re still relying on outdated infrastructure, you’re not just behind—you’re losing ground.

It’s Time for a Smarter Path Forward

Credit unions can’t afford to ignore the future. But the reality is—most teams are already stretched thin. Tackling these roadblocks to sustainable growth requires focus, time, and resources that may not be available internally.

That’s where the right external support like O2 Consulting can make a powerful difference.

We help credit unions streamline operations, introduce scalable tools, improve cross-departmental knowledge sharing, and rethink staffing strategies. We’ll get you up and running against today’s environmental and operational challenges—while your team stays focused on the day-to-day.

Sustainable growth doesn’t mean working harder, it means working smarter, with the right help by your side. Reach out to O2 Consulting today to start your sustainable growth journey.