Whether agile, waterfall or a hybrid of both methodologies, project management in credit unions is critical to the organization’s success. Consider whether a project runs smoothly over a six-month period or takes two years with numerous fits and starts, wasting time and energy, demoralizing the team.

The importance of strong project management in credit unions cannot be overstated. The market currently is valued at $4.8 billion and growing at a projected 5.5% CAGR, reaching $6.3 billion by 2028. Credit unions across the country are seeking top talent for these hard-to-fill positions, paying up to $122,000 and more in salary for project managers depending upon seniority and location, plus benefits. At that rate, credit union leaders have to wonder, is project management the type of work we should be investing so much on in-house, or might we earn a better ROI by outsourcing?

1. Project management methodologies

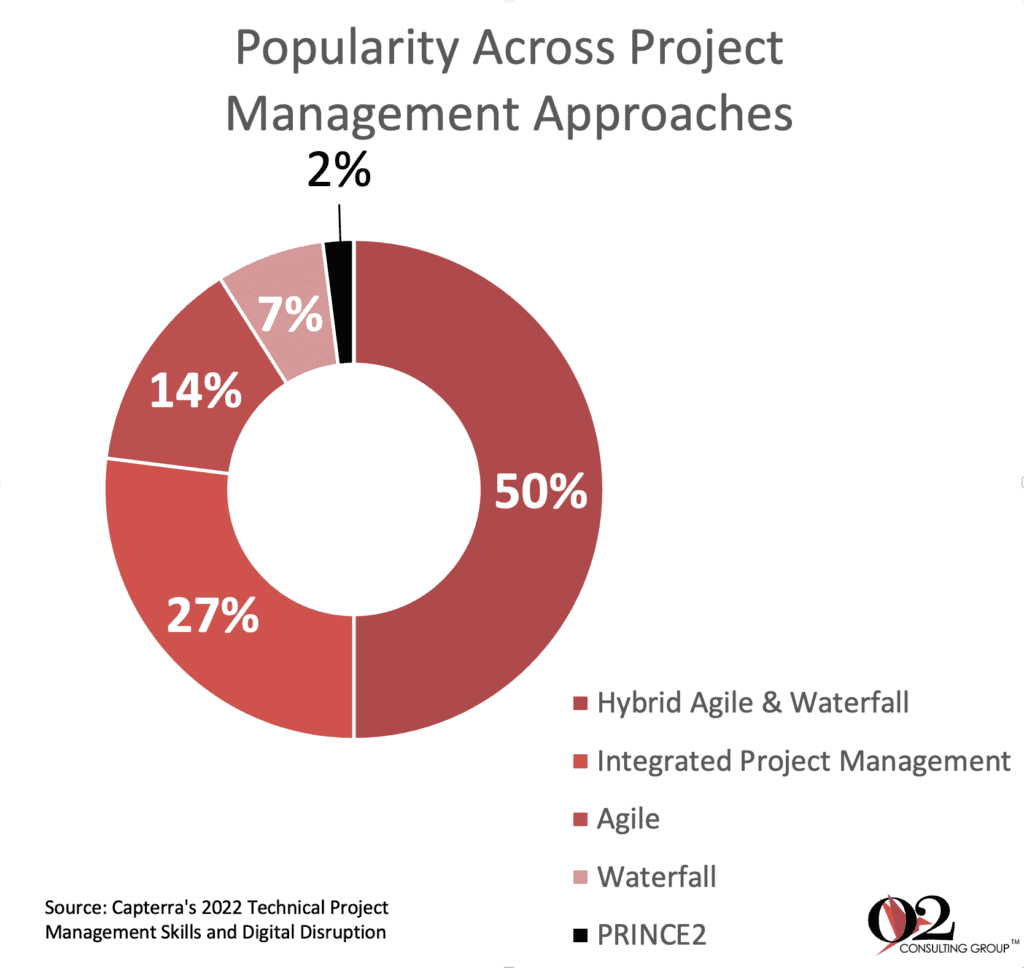

For a time, agile seemed to be overtaking waterfall project management, however, the trend is turning toward a hybrid approach with half of all project managers favoring the mixed methodology. Agile focuses on producing working deliverables over process documentation, whereas waterfall takes a set of predetermined steps in a particular order from design to implementation. As one would guess, hybrid is a combination of the best of both project management methodologies.

2. Accelerating technology changes

Technology is evolving quickly in every aspect of business, and project management is no exception. Artificial intelligence is helping to make project management and tracking easier. Software aids with everything from assigning tasks to communications to workflow diagrams. Machine learning can help forecast risk and mitigate it to optimize resource allocation and more. Robotic Process Automation can automate the most tedious of tasks and perform them more accurately, freeing up human resources for bigger-picture assignments. Document automation for compliance; the list goes on and on. All this technology can make project management much more efficient in expert hands.

3. Managing remote and hybrid teams

The pandemic is over, yet many workers have found they prefer working from home at least some of the time, and they intend to continue. And they might live anywhere around the world, so a high-tech, high-touch approach is appropriate to adapt. Project managers have had to adopt new software and strategies for leading their teams for everything from culture and employee engagement and relationships to scheduling calls across multiple time zones. So, in addition to the technical and technological,…

4. Developing soft skills is crucial

Some even call these “power skills.” Organizations that do not place a high priority on these power skills, according to the Project Management Institute, are at a higher risk for projects that do not meet business goals, that experience scope creep and that lose more budget if the project fails.

They’re critical to preserving and progressing leaders’ careers as well. Teams that have the right project management power skills are 32% less likely to lose their budgets, which means more projects and responsibilities.

At the same time, the demographics of the workforce could not be more diverse with three different generations comprising the bulk of employed people, and ethnicity among each generation becomes more and more diverse the younger they are. By the time Gen Z becomes a major player in the workplace, they will likely be the last majority-white generation by a slim margin, according to Pew Research. Handling diversity with empathy and inclusion is the key to a cohesive, innovative and dynamic project management team.

5. Data, data, data

Credit unions can leverage data to optimize resource allocation throughout projects, identify bottlenecks and make corrections, define short-term and longer-term action steps and keep projects on time and budget. Data can even help credit union project managers better forecast and manage a variety of risks associated with a project. But just because we have the data doesn’t mean we have the right talent; experienced project management leaders understand what to measure and why it’s relevant.

6. Change management

Some projects require shifting a mindset or an entire culture to garner the best possible outcomes from projects, like automating loan application reviews or evolving toward a digital-first credit union. Change is often met with resistance, so change management focuses on achieving the desired outcomes of the projects by guiding individuals and teams toward the preferred future state.

Project managers must ensure they garner support from the right people, including executive advocates, and form a coalition. Together, create and articulate a vision. They often hire outside consultants to gain a fresh perspective and help remove barriers. And don’t forget to recognize the team’s short-term wins toward the long-term goal!

7. Outsourcing

Businesses spent more than $700 billion on outsourcing in 2022, with IT and business process outsourcing leading the way. Each respectively grew 22% and 19% from their 2019 spends. The financial services, IT and telecommunications industries are expected to be the biggest drivers behind that growth.

Success in project management boils down to ensuring experienced project management leaders and forging the path forward. Ensuring your credit union has the right expertise on the project, preferably someone dedicated to the practice of project management, will ultimately save time, money and aggravation. In turn, each stakeholder must invest time to understand project management methods as appropriate for their level to support their teams. Contact O2’s experts and learn how we can support your credit union’s project management. Let’s talk!