By CUinsight

Setting aside any arguments for brick & mortar expansion vs. online/mobile growth – I think we’ll all agree that it’s an exciting time when your credit union is ready to expand. Whether you’re looking to expand to a nearby location in a market you know well, or are rapidly expanding into new markets with which you are less familiar, the question remains, where will you locate the new branch?

Investing in a new location is one of the largest financial commitments a credit union undertakes – opening a new branch can exceed two million dollars, depending on the region and other customization. And, this is before considering ongoing operational costs. Making a mistake can be costly – not only in real estate and construction costs, but also to your brand if you enter a market in a less-than-ideal location or end up exiting the market when results are not as you desired.

Your knowledge of the area is very valuable and so is that of local experts when entering new markets. The key is to support your knowledge with data that provides an objective analysis of market demographics and the competitive environment to reassure you, and your organization, that the underlying market/trade area drivers are as you perceive.

Here are four proven reasons why investing in a study and leveraging your credit union’s data on the front end of your strategy development can save you time and money:

With strong business acumen, your executive team has successfully grown your credit union to the point of being ready to expand. One part of why they’ve been so successful is because they know the business so well. Yet, this same internal entrenchment may also blur their sightline to broader trends and indicators.

1. Remove subjective bias

While it may seem counter-intuitive to say that someone from “the outside” can help you understand your local dynamics, a structured, objective analysis can provide a fresh perspective and often highlight trends that are overlooked by those who are in the market day to day.

2. Understand the trade area in terms of your members

A real estate broker is skilled at understanding the overall market and finding available property. Your broker likely does not specialize in credit union operations or have access to information about how members use your existing network.

You serve a unique set of members with their own behaviors and needs. Take time to assess retail activity in the area and analyze your existing member patterns and existing markets to cull out what has led to past success for your organization. Understanding your existing members, where they live, and how they currently transact within your network, provides essential insights into how you can best serve them in the market.

Leverage your member data to answer key questions, such as:

- How far do your members travel to a branch/ATM?

- How often do they visit? What types of transactions do they conduct in person?

- What other channels are they using for transactions?

3. Quantify opportunity and competitive pressures

“Our members have been asking for a location in Springfield.” Listening to members is incredibly important, and it’s one piece of the puzzle. Another vital puzzle piece is assessing the potential of the recommended area.

- Are there sufficient households to support a location? How much growth is projected?

- What financial products are market households purchasing?

- How competitively intense is the market?

Quantifying the financial product potential and competitive environment in the trade area is valuable for setting growth goals and estimating what market share you can reasonably expect to grab and how that will affect your profit. It will also influence the type of building and services offered at this location.

An important consideration at this step is determining where you will obtain the market data and understanding whether you will have the ability to customize the data for the geographies you are considering. Free data sources generally offer zip code or county-level census data. While county or zip code level data helps narrow a search between different markets (i.e. which cities or counties are attractive for expansion?), it is less helpful in pinpointing areas of growth or targeting demographics within a submarket (i.e. where do we place a branch in this city or neighborhood?).

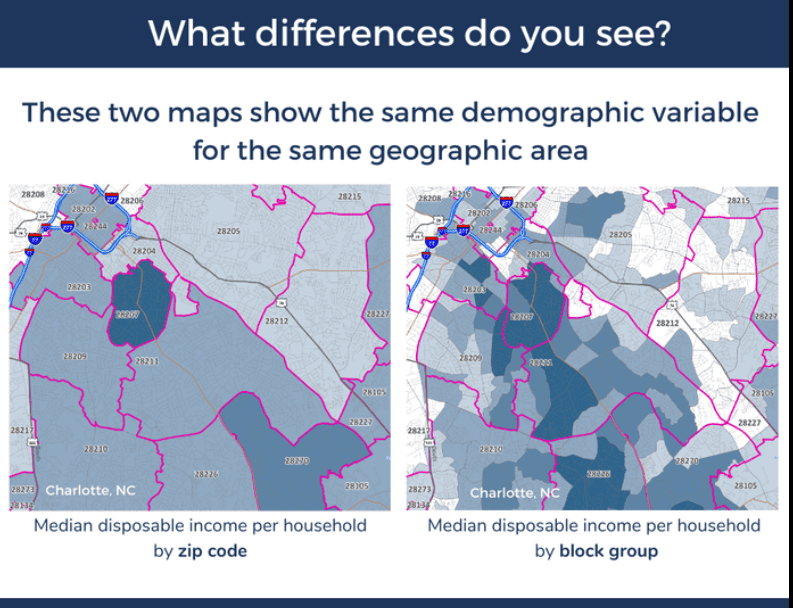

For example, the maps of Charlotte, NC below illustrate how a map showing the median income for a zip code (left) washes out the variation within the market, which is evident when you assess the market at the block group level (right). Missing these variations may lead to misinterpreting a submarket and building a branch in an unfavorable location. It’s much less expensive to spend a little on verifying the data sources of your analysis inputs than it is to relocate a misplaced branch.

4. Gain stakeholder consensus

Adding a branch is a big deal. It’s a change to the way things have been done and it’s expensive. Consequently, stakeholder discussions leading up to a branch strategy decision can get emotional with strong feelings about whether a new branch is necessary or disagreements about the best place to locate it. So often, in the absence of objective third-party criteria, the decision-making process is unnecessarily drawn out and market opportunities are missed. Having well-researched, data-driven evidence to share with the board of directors and the executive team will focus discussions, support or debunk theories, and streamline the decision process.

Once you commit to a property and open a branch, it’s not only pricey to relocate the branch, it can also negatively impact the credit union’s reputation and frustrate members. A little investment up front in a branch strategy analysis will equip you with a better understanding of your members and markets and lead you to the location(s) that will best serve your current and future member base.

Originally published by CUInsight.com

Contact O2 to see how we can help your organization at GetResults@O2ConsultingGroup.com