Strategic Consulting Leads to Major Gains in Efficiency and Cost Savings

BACKGROUND:

Money One Federal Credit Union, headquartered in Largo, Maryland, is a trusted financial institution serving a diverse community of over 12,000 members. With assets totaling approximately $163 million, Money One has a strong presence in Maryland, offering a range of financial products and services designed to meet the needs of its members. Despite its reputation and commitment to members, the credit union was facing an ongoing challenge of rising delinquency rates, impacting the credit union’s financial health.

THE CHALLENGE:

To address the challenge of rising delinquency rates and to realign their operations with industry best practices for collections, Money One partnered with O2 Consulting Group.

“Our methodology for assisting Money One FCU involved a dual perspective, deeply rooted in improving+ both operational processes and people dynamics. This balanced approach enabled us to drive sustainable change that met the credit union’s needs head-on,” shared Bonnie Ortiz, CEO of O2 Consulting Group. The engagement was focused on reducing delinquency rates through a strategic approach that included optimizing staffing, refining work processes, and streamlining vendor management.

METHODOLOGY:

The following interventions were carefully designed to drive operational change and enhance efficiency within the credit union.

- Staff Reorganization:

- Comprehensive People Audit: The first step in the transformation process was a thorough review of the existing staff. O2 Consulting conducted a people audit to assess the competencies, performance, and alignment of the staff with the credit union’s goals. As a result, some employees left voluntarily, while others were let go due to misalignment with the new direction.

- Targeted Hiring: The credit union then hired a new manager and two new collections specialists with proven backgrounds in collections. These new hires brought fresh perspectives and expertise to the team, which was critical in driving change.

- Enhanced Training Programs: Training was given special consideration in the reorganization process. The original team lacked a deep understanding of key collection metrics and their impact on the credit union’s financial performance. O2 Consulting implemented a training program focused on enhancing the staff’s understanding of collections ratios, effective communication, and empathetic member interactions. This training was crucial in shifting the team’s approach to collections, emphasizing listening and member support over aggressive tactics.

- Restructured Reporting Lines: To improve oversight and strategic alignment, O2 Consulting recommended changing the reporting structure, with the collections department now reporting directly to the CEO instead of the VP of Finance. This change facilitated quicker decision-making and ensured that collections were prioritized at the highest level of the organization.

- Improving Work Processes:

- Detailed Workflow Mapping: O2 Consulting undertook a comprehensive mapping of all collection processes, including consumer collections, auto loan repossessions, secured and unsecured loans, negative accounts, and reporting. This exercise revealed several inefficiencies, such as the failure to file insurance paperwork, which led to missed opportunities for insurance recoveries on a significant number of loans.

- Process Optimization: The team discovered that the collections staff was not prioritizing calls based on the time of the month or the amount owed, leading to suboptimal collections outcomes. By introducing a more strategic approach to call prioritization, O2 Consulting ensured that the collections process became more efficient and effective.

- Compliance Improvements: A critical compliance gap identified was the lack of proper documentation and record-keeping. The credit union was not consistently saving copies of the required letters for vehicle repossessions, and certified mail records were missing in many cases. O2 Consulting implemented standardized procedures and introduced a shared digital storage system to ensure that all compliance documentation was properly maintained and accessible to the entire collections team.

- Vendor Evaluation and Cost Reduction:

- Vendor Review and Rationalization: Money One initially had three third-party collection vendors, which was not only redundant but also costly. O2 Consulting conducted a thorough review of these vendors, assessing their performance and cost-effectiveness. As a result, the credit union reduced the number of vendors, leading to substantial cost savings.

- In-House Collections: The ultimate goal of the vendor evaluation was to move all collections in-house, eliminating the need for third-party vendors. Although this transition is ongoing, the credit union is continuously reviewing its capabilities to achieve this objective. The reduction in vendor dependency has already led to large savings, further contributing to the credit union’s financial stability.

RESULTS:

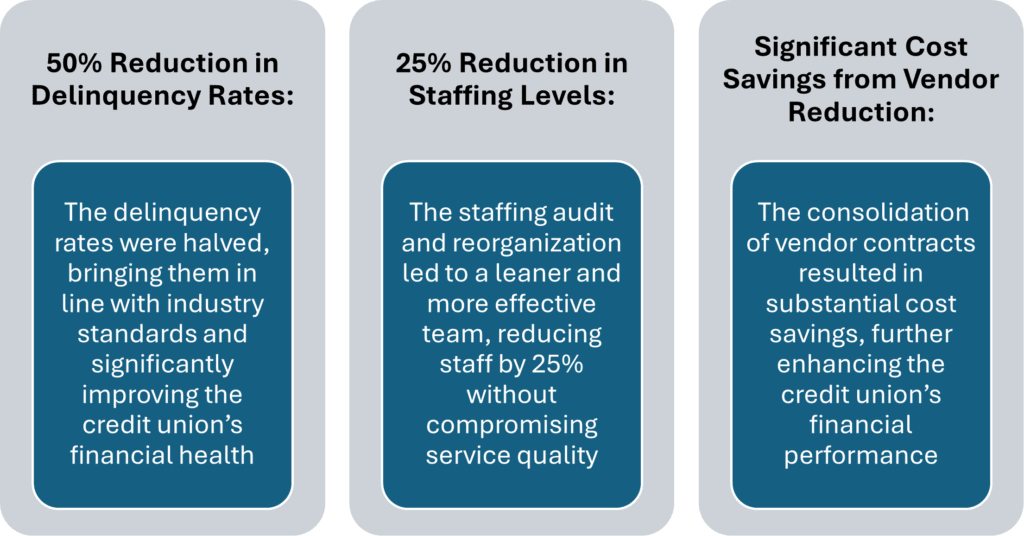

The interventions by O2 Consulting Group yielded remarkable results, positioning Money One Federal Credit Union for long-term success:

O2 Consulting Group’s holistic approach to transforming Money One Federal Credit Union’s operations has led to significant improvements in efficiency, cost management, and compliance for their collections department.

Beverly Zook, President & CEO of Money One FCU, highlighted, “The transformation at Money One has been nothing short of remarkable. Our delinquency rates are now in line with industry standards, our collections team is more streamlined and effective, and we’ve achieved substantial savings by reducing our reliance on third-party vendors.“

This case study demonstrates the power of strategic consulting in creating sustainable, impactful change through a balanced focus on both operational excellence and human elements. If you are looking to optimize your collections processes, reach out to us today to find how we can help you.